June’s retail sales, industrial production, and new housing starts: May’s business inventories

Major reports that were released this week included the Retail Sales Report for June, the June report on New Residential Construction and the Business Sales and Inventories Report for May, all from the Census Bureau, and the June report on Industrial Production and Capacity Utilization from the Fed…in addition, the week also saw the release of the Regional and State Employment and Unemployment Report for June, a report from the Bureau of Labor Statistics which breaks down the two employment surveys from the monthly national jobs report by state and region….while the text of this report provides a useful summary of this data, the serious statistics aggregation can be found in the tables linked at the end of the report, where one can find the civilian labor force data and the change in payrolls by industry for each of the 50 states, the District of Columbia, Puerto Rico, and the Virgin Islands…

This week also saw the release of the first two Fed regional manufacturing reports for July: the Empire State Manufacturing Survey from the New York Fed, which covers New York state, southwestern Connecticut, northern New Jersey, reported their headline general business conditions index slipped from –6.0 June to –6.6 in July, indicating that slightly larger plurality of Second District manufacturers again saw conditions deteriorating during the month, while the Philadelphia Fed Manufacturing Outlook Survey, covering most of Pennsylvania, southern New Jersey, and Delaware, reported its broadest diffusion index of manufacturing conditions rose to +13.9 in July, after readings of +1.3 in June and +4.5 in May, which they explain was because “nearly 39 percent of the firms reported increases in general activity this month, while 25 percent reported decreases; 29 percent reported no change…” (note that the index value is computed by subtracting the perecnt of negative responses from positive ones)

Retail Sales Little Changed in June After April and May Sales were Revised Higher

Seasonally adjusted retail sales were barely changed in June after retail sales for May were revised higher….the Advance Retail Sales Report for June (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled $704.3 billion during the month, which was statistically unchanged (±0.5 percent)* from May’s revised sales of $704.5 billion, but were 2.3 percent (±0.5 percent) above the adjusted sales in June of last year…May’s seasonally adjusted sales were revised almost 0.2% higher, from the $703.1 billion reported last month to $704.5 billion, while April’s adjusted sales were revised less than half of 0.1% higher, from $702.5 billion to $702.7 billion, and as a result the change from April to May was revised to an increase of 0.3%, from the 0.1% increase reported a month ago….estimated unadjusted sales, extrapolated from surveys of a small sampling of retailers, indicated June sales actually fell 5.6%, from $745,229 million in May to $703,632 million in June, while they were up just 0.2% from the $702,231 million of sales in June a year ago…

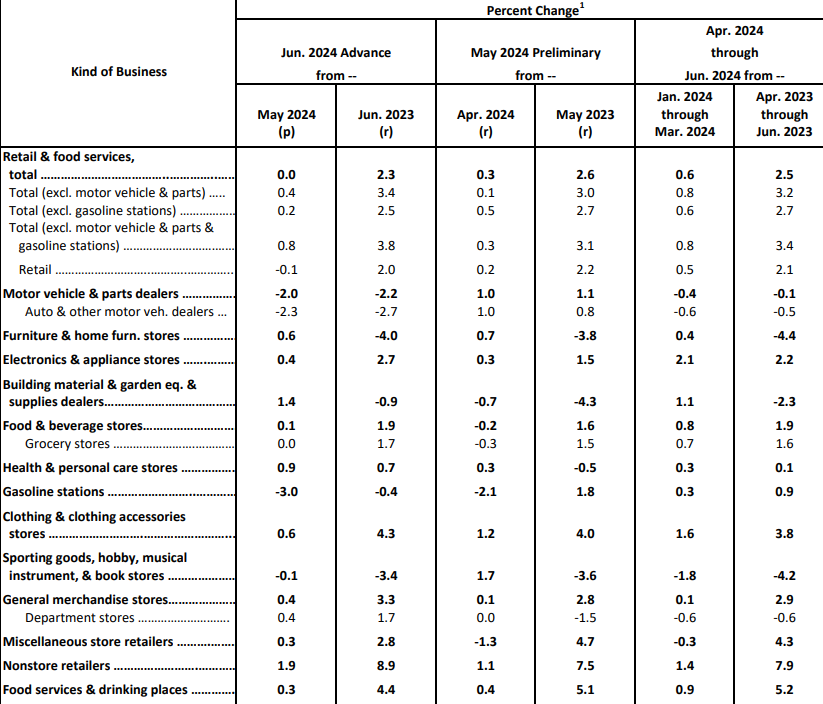

Included below is the table of the monthly and yearly percentage changes in sales by business type that we’ve taken from the Census retail sales pdf….the first pair of columns below gives us the seasonally adjusted percentage change in sales for each type of retail business from May to June and the year over year percentage change for those businesses since last June; the second pair of columns gives us the revised figures for May’s report, with April to May and the May 2023 to May 2024 change shown in those two columns…for your reference, our copy of this table as it appeared in the May advance report, before the revisions you see below, is here….lastly, the third pair of columns below shows the percentage change of the recent 3 months of sales (April, May and June) from the preceding three months (January, February and March) and from the same three months of a year ago….(click to enlarge)

The figures shown in that fifth column above, ie, comparing the sales of April, May and June to those of January, February and March, give us a quick sense of how the change in retail sales will impact the change in 2nd quarter GDP….as you can see, nominal retail sales for the three months of the second quarter were up 0.9% from the first three months of this year, which as you know, need to be adjusted for the price changes of the corresponding months before inclusion in the growth of GDP..

To compute June’s real personal consumption of goods data for national accounts from this June retail sales report, the BEA will use the corresponding price changes from the June consumer price index, which we reviewed last week…to estimate what they will find, we’ll first separate out the volatile sales of gasoline from the other totals…from the third line on the above table, we can see that June retail sales excluding the 3.0% decrease in sales at gas stations were up by 0.2%…..then, by subtracting the actual dollar amounts representing the 0.1% increase in grocery & beverage sales and the 0.3% increase in food services sales from that total, we find that core retail sales were up by more than 0.2% for the month….since the June CPI report showed that the composite price index of all goods less food and energy goods was 0.1% lower in June, we can thus figure that real retail sales excluding food and energy will show an increase of more than 0.3%…however, the actual adjustment in national accounts for each of the types of sales shown above will vary by the change in the related price index…for instance, while nominal sales at motor vehicle & parts dealers were down 2.0% in June, the June price index for transportation commodities other than fuel was 0.6% lower, which would suggest that real unit sales at auto & parts dealers were on the order of 1.4% lower once lower prices are taken into account….similarly, while nominal sales at clothing stores were 0.6% higher in June, the apparel price index was 0.1% higher, which means that real sales of clothing only rose around 0.5%…likewise, while sales at furniture and home furnishing stores were 0.6% higher, the price index for furniture and bedding was was 0.9% lower, which means real sales of furniture and home furnishings likely rose by around 1.5%….

In addition to figuring those core retail sales, to make an estimate of the month’s change in real sales, we’ll need to adjust food and energy retail sales for their price changes separately, just as the BEA will do.…the June CPI report showed that the food price index was 0.2% higher, as the price index for food purchased for use at home was 0.1% higher in June, while the index for food bought to eat away from home was 0.4% higher, as prices at fast food outlets rose 0.2% and prices at full service restaurants rose 0.6%…thus, the 0.1% increase in nominal sales at food and beverage stores was due to higher prices, and real sales of groceries did not change….meanwhile, the 0.3% increase in nominal sales at bars and restaurants, once adjusted for 0.4% higher prices, suggests that real sales at bars and restaurants probably fell around 0.1% during the month….on the other hand, while sales at gas stations were down 3.0%, there was an 3.8% decrease in the price of gasoline during the month, which would suggest that real sales of gasoline were up more than 0.8%, with a caveat that gasoline stations do sell more than gasoline, products which should not be adjusted with the change in gasoline prices…reweighing and averaging the real sales changes that we have thus estimated back together, and excluding food services, we can then estimate that the income and outlays report for June will show that real personal consumption of goods rose by more than 0.3% in June, after rising a revised 0.8% in May, but after falling by a unrevised 0.7% April, after rising by 0.7% in March, falling by 0.1% in February and falling by 1.3% in January…at the same time, the 0.1% decrease in real sales at bars and restaurants will have a small negative impact on growth rate of June’s real personal consumption of services….

Industrial Production Rose 0.6% in June After May Production was Revised Higher

The Fed’s G17 release on Industrial production and Capacity Utilization for June reported that seasonally adjusted industrial production rose 0.6% in June after rising by a revised 0.9% May, and was hence up 1.6% from a year ago, after rising 4.3% annual rate over the 2nd quarter as a whole….the industrial production index, with the benchmark now set for average 2017 production to equal to 100.0, rose from 103.3 in May to 104.0 in June, after the May reading for the IP index was revised up from 103.1 to 103.3, the April index was revised but unchanged at 102.4, the March index was revised from 102.5 to 102.4, the February index was revised up from 101.7 to 101.6, and the January index was revised from 101.7 to 101.5….

The manufacturing index, which accounts for around 77% of the total IP index, increased by 0.4% in June, as the manufacturing index rose from 99,9 in Mayto 100.3 in June, after the May manufacturing index was revised from the 99.5 published last month to 99.9, the April manufacturing index remained unrevised at 89.9, the March index was revised from 99.5 to 99.4, the February manufacturing index was revised from 99.3 to 99.2, and the January manufacturing index was revised from 98.2 to 97.9….meanwhile, the mining index, which includes oil and gas well drilling, increased by 0.3%, from 119.0 in May to 119.3 in June, after the May index was revised up from the originally reported 117.9, which still left the mining index 0.6% below what it was a year ago….finally, the seasonally adjusted utility index, which often fluctuates due to above or below normal temperatures, rose 2.8% to 109.7 in our hot June, after the May index was revised down from 107.8 to 106.7, which left the utility index 7.9% above its year earlier reading…

This report also includes capacity utilization figures, which are expressed as the percentage of our plant and equipment that was in use during the month…seasonally adjusted capacity utilization for total industry rose to 78.8% in June from 78.3% in May, after capacity utilization for May was revised down from the 78.7% reported a month ago….capacity utilization by NAICS durable goods production facilities rose from 77.5% in May to 77.7% in June, while capacity utilization for NAICS non-durable producers rose from 79.1% to 79.7%…capacity utilization for the mining sector rose to 89.3% in June, from a revised 89.0% in May, which was originally reported as 92.7%, while utilities were operating at 73.8% of capacity during June, up from a revised 72.0% May, which was originally published as 71.5%…for more details on capacity utilization by type of manufacturer, see Table 7: Capacity Utilization: Manufacturing, Mining, and Utilities, which shows the historical capacity utilization figures for a dozen types of durable goods manufacturers, 8 classifications of non-durable manufacturers, mining, utilities, and capacity utilization for a handful of other special categories….

Business Sales ‘Unchanged’ in May; Business Inventories Rose 0.5%

Following the release of the June retail sales report, the Census Bureau released the composite Manufacturing and Trade Inventories and Sales report for May(pdf), which incorporates the revised May retail data from that June report and the previously published wholesale and factory data for May to give us a broad picture of the business contribution to the economy for that month….according to the Census Bureau, total manufacturer’s and trade sales were estimated to be valued at a seasonally adjusted $1,861.4 billion in May, virtually unchanged (±0.1 percent)* from April’s revised sales, but 2.0 percent (±0.3 percent) higher than May’s sales of a year earlier…note that total April sales were revised from the originally reported $1,862.4 billion to $1,861.4 billion, and hence their change from March was revised from +0.3% to +0.2%… manufacturer’s sales were down 0.7% from April at $584,805 million during May, while retail trade sales, which exclude restaurant & bar sales from the revised May retail sales reported earlier, rose 0.2% to $609,908 million, and wholesale sales rose 0.4% to $666,727 million…

Meanwhile, total manufacturer’s and trade inventories, a major component of GDP, were estimated to be valued at a seasonally adjusted $2,558.5 billion at the end of May, up 0.5 percent (±0.1%) from April, and 1.6 percent (±0.4 percent) higher than in May a year earlier…the value of end of April inventories were revised to $2,546.2 billion from the $2,545.2 billion reported here last month, but are still a 0.3% increase from March.…seasonally adjusted inventories of manufacturers were estimated to be valued at $860,133 million, 0.2% more than in April, while inventories of retailers were valued at $796,594 million, 0.6% more than in April, and inventories of wholesalers were estimated to be valued at $901,725 million at the end of May, also 0.6% more than in April…

In national accounts reports, the various categories of business inventories will be adjusted for price changes using item appropriate price indexes from the producer price index….with the release of wholesale inventories data last week, we figured that a real wholesale inventory increase over April and May would reverse the decrease in real wholesale inventories in the first quarter, and hence would have a positive impact on the growth rate of 2nd quarter GDP….at the same time,the inflation adjusted factory inventory data from two weeks ago indicated a small increase in May’s real inventories, following a similar increase in April, after the increase in first quarter factory inventories were even smaller, and hence they would also have small positive impact on the growth rate of 2nd quarter GDP....with prices for finished goods on average 0.8% lower in May, this report suggests that real retail inventories had increased at a rate of about 1.4% in May, following a real increase of around 0.3% in April….however, since the key source data and assumptions (xls) for the second estimate of 1st quarter GDP indicated that 1st quarter real retail inventories had accounted for most of the 1st quarter inventory increase, any increase in the 2nd quarter’s real retail inventories that is smaller than that would subtract from 2nd quarter GDP by the difference between the increases of the two quarters…hence what is so far a negative impact on GDP from retail inventories appears to mostly offset the positive impact from factory and wholesale inventories…

New Housing Starts and Building Permits Reported Higher in June

The June report on New Residential Construction (pdf) from the Census Bureau estimated that new housing units were being started at a seasonally adjusted annual rate of 1,353,000 in June, which was 3.0 percent (±10.5 percent)* above the revised May estimated annual rate of 1,314,000 units started, but was 4.4 percent (±12.7 percent)* below last June’s pace of 1,415,000 housing starts annually…the asterisks indicate that the Census does not have sufficient data to determine whether housing starts actually rose or fell from May or even from those of last June, with the figure in parenthesis the most likely range of the change indicated; in other words, June’s housing starts could have been down by 7.5% or up by as much as 15.5% from those of May, with revisions outside of that range also eventually possible…with this report, the annual rate for May housing starts was revised from the 1,277,000 units reported last month to 1,314,000, while April’s housing starts, which were first reported at a 1,360,000 annual rate, were revised from last month’s initial revised annual figure of 1,352,000 annually up to a 1,377,000 annual rate with this report…

The annual rates of housing starts reported here were extrapolated from a survey of a small percentage of US building permit offices visited by Census field agents, which estimated that 126,100 housing units were started in June, up from the 120,200 units started in May but down from the 132,600 units started in June of a year ago…of those housing units started in June, an estimated 92,300 were single family homes and 32,600 were units in structures with more than 5 units, up from the revised 92,100 single family starts in May, and up from the the 26,600 units started in structures with more than 5 units in May..

The monthly data on new building permits, with a smaller margin of error, are probably a better monthly indicator of new housing construction trends than the volatile and broadly revised housing starts data…in June, Census estimated new building permits were being issued for a seasonally adjusted annual rate of 1,446,000 housing units, which was 3.4 percent above the revised May rate of 1,399,000 permits, but was 3.1 percent below the June 2023 rate of 1,493,000 the rate of building permit issuance in June a year earlier…the annual rate of housing permits issued in May was revised from the 1,386,000 reported last month to 1,399,000…

Again, the annualized estimates for new permits reported here were extrapolated from the unadjusted estimates collected by canvassing census agents, which showed permits for 125,000 housing units were issued in June, down from the revised estimate of 132,400 new permits issued in May…the June permits included 83,300 permits for single family homes, down from 94,100 in May, and 37,300 permits for housing units in apartment buildings with 5 or more units, up from 33,100 such multifamily permits a month earlier…

(the above is the synopsis that accompanied my regular sunday morning news links emailing, which in turn was mostly selected from my weekly blog post on the global glass onion…if you’d be interested in receiving my weekly emailing of selected links, most of which are picked from the aforementioned GGO posts, contact me…)

Comments

Post a Comment